Used car sales continue to climb as Americans search for dependable vehicles at affordable prices. In-house financing is just one reason why vehicle purchasers find some used car dealerships attractive.

Wondering if an in-house financing dealership is the best choice for you when purchasing a used car? Here are four benefits to consider.

An in-house financing dealership is your one stop shop for both securing a loan and driving the car off the lot. There's no extra trip to the bank required to work with a loan officer.

Peace of mindAn in-house financing dealer specializes in securing financing for auto purchasers, so you're working with an expert in their field whose energy is not divided between home or other types of loans. You can also use a car comparison site such as Kelley Blue Book to ensure you get the best price for the car you're purchasing.

Benefits for all types of creditWhether your credit is impeccable, you have no credit history, or you have poor credit, in-house financing helps purchasers with any type of credit secure a loan for their used car.

Personal relationshipWhen you're working with an in-house financing dealer, they'll get to know your financial history, your needs and your vehicle desires inside and out to secure the best affordable vehicle for you. In-house financing dealers want to help you realize your car dreams and have flexible options to get you there.

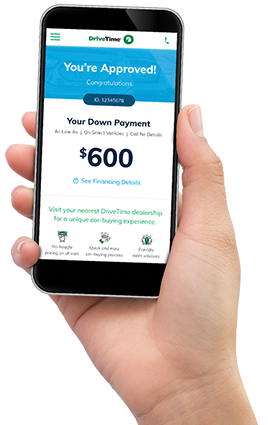

Dealerships who offer the opportunity to obtain a loan without ever leaving the dealership is the definition of “in-house financing." There are many in-house financing loan programs, from major dealerships like Toyota, to buy here pay here car lots.

Before you decide whether or not to use an in-house financing car dealership, shop around and compare interest rates, discounts and other deals. Compare not only the monthly payment, interest rates, loan lengths, but early payment penalties and any hidden fees. In-house financing car dealerships can offer great deals; the key is being an educated consumer so you can determine what works best for you, traditional financing or in-house financing.

In-house financing means a borrower signs an auto loan directly from the dealership. In-house financing dealerships may have higher interest rates than regular lenders like banks and credit unions, but it can be a good choice for those with bad credit or no credit since in-house financing companies may approve them when others won’t. It’s also convenient because you don't have to shop around for financing later.

In a conversation with the in-house financing dealer, you'll be negotiating the loan terms, including the loan length, a down payment amount, and the interest rate on the loan. Putting up a large down payment may help you negotiate for a lower rate or a longer loan length, since this decreases the risk the financing company has to take.

In-house financing dealerships may be able to offer incentives that banks and credit unions can't, like flexible interest rates, extended warranties and increased services. In-house financing dealerships may also move faster and be more convenient than other lenders so you can get on the road in your next car.

- In-House Financing Albany

- In-House Financing Albuquerque

- In-House Financing Atlanta

- In-House Financing Augusta

- In-House Financing Austin

- In-House Financing Bakersfield

- In-House Financing Baltimore

- In-House Financing Baton Rouge

- In-House Financing Birmingham

- In-House Financing Charleston

- In-House Financing Charlotte

- In-House Financing Chattanooga

- In-House Financing Chicago

- In-House Financing Chicago

- In-House Financing Cincinnati

- In-House Financing Cleveland

- In-House Financing Colorado Springs

- In-House Financing Columbia

- In-House Financing Columbia-Missouri

- In-House Financing Columbus

- In-House Financing Columbus GA

- In-House Financing Corpus Christi

- In-House Financing Dallas

- In-House Financing Dayton

- In-House Financing Denver

- In-House Financing Des Moines

- In-House Financing Detroit

- In-House Financing El Paso

- In-House Financing Fayetteville

- In-House Financing Fort Myers

- In-House Financing Fresno

- In-House Financing Ft Wayne

- In-House Financing Gainesville

- In-House Financing Grand Rapids

- In-House Financing Greensboro

- In-House Financing Greenville

- In-House Financing Greenville NC

- In-House Financing Houston

- In-House Financing Huntsville

- In-House Financing Indianapolis

- In-House Financing Jackson

- In-House Financing Jacksonville

- In-House Financing Kansas City

- In-House Financing Knoxville

- In-House Financing Las Vegas

- In-House Financing Lexington

- In-House Financing Los Angeles

- In-House Financing Louisville

- In-House Financing Lubbock

- In-House Financing Macon

- In-House Financing Memphis

- In-House Financing Miami

- In-House Financing Minneapolis

- In-House Financing Mobile

- In-House Financing Myrtle Beach

- In-House Financing Nashville

- In-House Financing Norfolk

- In-House Financing Oklahoma City

- In-House Financing Orlando

- In-House Financing Pensacola

- In-House Financing Peoria

- In-House Financing Philadelphia

- In-House Financing Philadelphia

- In-House Financing Philadelphia

- In-House Financing Phoenix

- In-House Financing Pittsburgh

- In-House Financing Reno

- In-House Financing Richmond

- In-House Financing Roanoke

- In-House Financing Sacramento

- In-House Financing Salt Lake City

- In-House Financing San Antonio

- In-House Financing San Diego

- In-House Financing Savannah

- In-House Financing Shreveport

- In-House Financing South Bend

- In-House Financing Springfield

- In-House Financing St Louis

- In-House Financing TYLER

- In-House Financing Tallahassee

- In-House Financing Tampa

- In-House Financing Toledo

- In-House Financing Topeka

- In-House Financing Tucson

- In-House Financing Tulsa

- In-House Financing Washington DC

- In-House Financing Washington DC

- In-House Financing West Palm Beach

- In-House Financing Wichita

- In-House Financing Wilmington