You’ve probably driven by a dealership advertising that it’s a “tote the note car lot,” or seen a TV commercial touting “tote the note.” If you wonder what that means, it’s quite simple: auto loans are also known as notes, and most car dealers use banks and other third parties for financing. That’s not the case with tote the note dealers.

Tote the note car lots handle their own financing. It’s the equivalent of in-house financing. That also means people who may have been turned down for having bad credit at standard dealerships can purchase a vehicle at a tote the note car lot. Tote the note financing usually involves weekly, instead of monthly, payments.

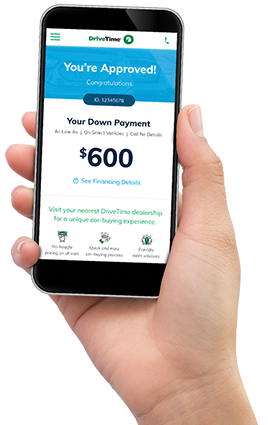

You may know whether you’re approved at a tote the note dealer before you arrive at the lot if the business offers online financing. Otherwise, you’ll present any required documentation to the tote the note dealer before choosing a car. The dealership will help you decide which cars you can afford based on their financing terms. Then you will be able to test drive vehicles in your price range.

During your search for a car and an auto loan, you might come across "tote the note" car lots, which are the same as "buy here pay here" dealerships. Tote the note auto dealerships offer financing in house, instead of sending their car buyers to third parties like banks or credit unions (which is what traditional dealers do). Tote the note financing is different for three main reasons: the buying process is reversed, different credit situations can be approved, and dealers might not report to credit bureaus.

With tote the note dealers, you don't have to go to the trouble of negotiating with lenders--your dealership is the lender. When you go to a tote the note car lot, you can speak to a finance manager first thing to iron out the details of your loan. This means you can find out your budget for a car upfront, before you start shopping for one, so once you begin looking you already know which cars at the tote the note dealership you can afford.

Because some tote the note dealers don't perform credit checks, there's also the possibility they won't report to credit bureaus either. This means your credit won't improve even if you make your payments on time, since the tote the note dealer isn't reporting it. If you're working on your credit score, try your best to find a tote the note dealer that will report your payments regularly.

Has your credit history prevented you from securing an auto loan with a traditional lender? Tote the note dealers are a great option as they provide in-house financing for consumers with bad or no credit.

Before you apply for financing with a tote the note dealer, here are some important questions to ask:

- Will I qualify for tote the note financing if I have a poor credit score, minimal credit history or recently filed for bankruptcy?

- Do I need a cosigner to qualify for tote the note financing?

- How long is the application process for tote the note financing?

- What documents will you need to process my financing application?

- Will you evaluate my credit history before making a loan decision?

- Is there are a fee to apply for tote the note financing?

- If I am approved for tote the note financing, what kind of interest rate should I expect?

- Will I need funds for a down payment?

- Do you report payment activity to the credit bureaus?

- Will I incur a penalty if I pay the loan off early?

- What’s your return policy on cars acquired through tote the note financing?

- Where do you purchase your vehicles?

- Do you have a copy of the vehicle history report? If so, can I review it?

- What was the last service performed on the car?

- Can I trade in my current vehicle?

By asking the right questions at a tote the note dealership before driving off the lot, you will score the best deal on your next used car purchase. You will also avoid being victimized by hidden financing terms or scams.

Tote the note dealers can help you get the financing you need for your next car. While tote the note car lots tend to have a bad reputation, there are many benefits, once you understand them.

Tote the note dealers directly finance cars that they sell. This means that you apply for financing at the dealership instead of a bank or credit union. Tote the note financing is easier to arrange because the financing decision is made by the dealer directly. Usually, the financing terms are based on the car's value, your down payment amount, and your credit score.

Once you’ve been approved by a tote the note dealer, they can help you find a vehicle within your price range. All of this can often be done in less than a day.